Qualifying Life Event for Dummies

Not known Facts About Qualifying Life Events - Human Resources

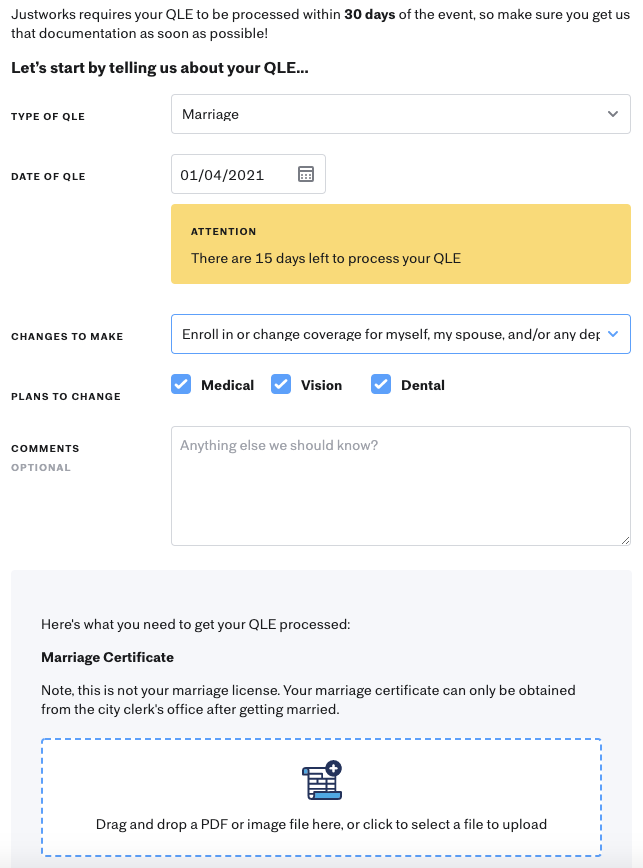

Much of life's big minutes might unlock to making modifications to your health insurance protection outside of the regular open enrollment period. More Details can most typically be made either 30 or 60 days after the certifying life event takes place. If you have actually experienced a qualifying life occasion, examine your plan materials, call your company or call the telephone number on your member ID card.

See what life occasions qualify for an unique registration duration (SEP), files required to use, and when your protection might start. Selecting to stop other health coverage; being terminated for not paying your premiums; learning your doctor isn't covered through your plan.

A modification in your circumstance like marrying, having an infant, or losing health coverage that can make you qualified for a Special Registration Duration, permitting you to register in health insurance outside the yearly Open Enrollment Period. Begin highlighted text End highlighted text, There are 4 basic types of certifying life occasions.

List of authorized qualifying life occasions in accordance with ERISA Area 125: Marital relationship, divorce or legal separation Birth or adoption of a kid Death of a partner or kid Change in residence or work area that impacts benefits eligibility for you or your covered reliant(s) Your child(ren) fulfills (or fails to satisfy) the plan's eligibility rules (for example, trainee status changes) You or one of your covered dependents gain or lose other advantages coverage due to a modification in employment status (for example, starting or ending a job) Registration should be finished within thirty days of the effective date of the Qualifying Life Event.

Little Known Questions About Qualifying Life Event - What Is It - Anthem.

Please visit Workday to process all Qualifying Life Events within one month of the certifying event.

A qualifying life event enables you the opportunity to enlist and/or make changes to existing coverage for yourself or your dependents beyond the annual Open Registration period. You must make these modifications no behind 31 calendar days from the date the certifying event happened, unless a different due date is shown for a particular qualifying life event.

ASRS has the sole discretion to figure out whether a Qualifying Life Occasion has taken place and whether your situation allows you to register or make changes to existing protection. ASRS supplies the opportunity for its members to register in the strategy, however there are eligibility restrictions for people registered in other health insurance.

UNDER MAINTENANCE